UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

the Securities Exchange Act of 1934 (Amendment No. ___))

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material |

AMREP CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Thanother than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| ¨ | Fee paid previously with preliminary |

AMREP CORPORATION

(Anan Oklahoma corporation)

NOTICE OF 20202022 ANNUAL MEETING OF SHAREHOLDERS

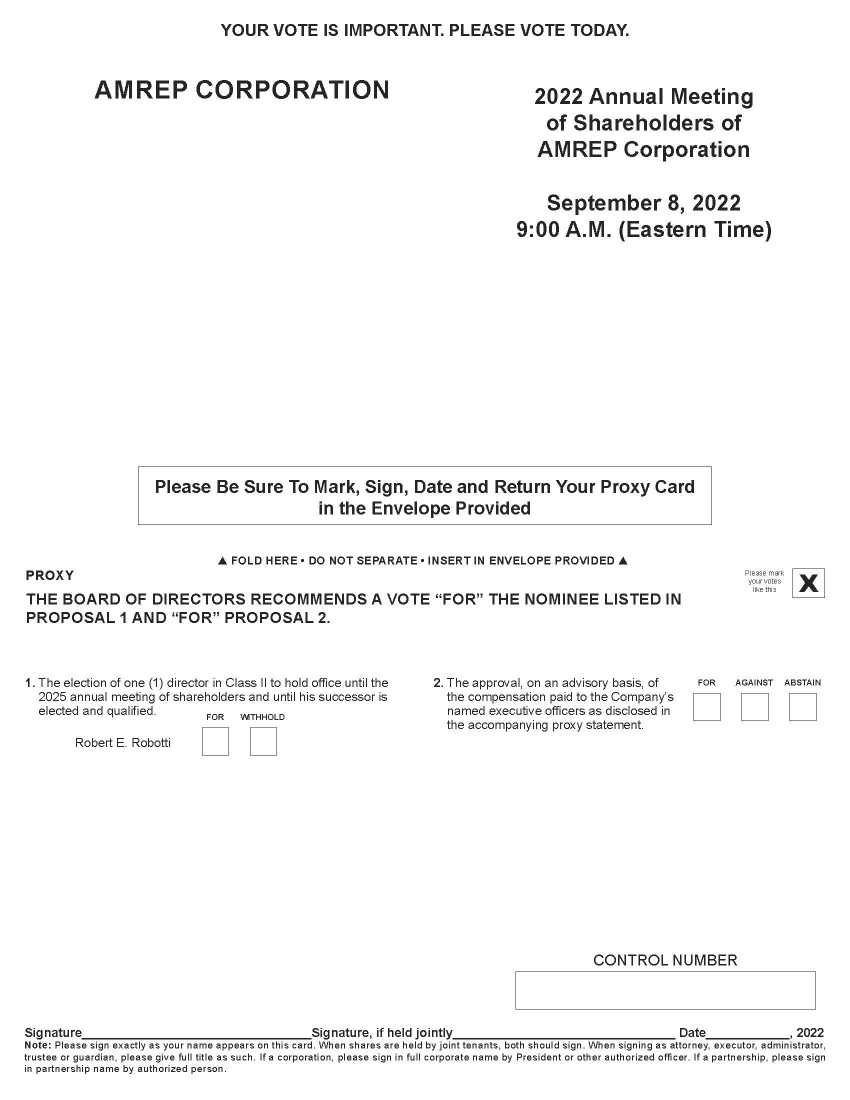

September 10, 20208, 2022

NOTICE IS HEREBY GIVEN that the 20202022 Annual Meeting of Shareholders of AMREP Corporation (the “Company”) will be held at the Conference CenterFairfield Inn & Suites at 660 West Germantown Pike, Plymouth Meeting,100 Lawrence Road, Broomall, Pennsylvania 1946219008 on September 10, 20208, 2022 at 9:00 A.M. Eastern Time for the following purposes:

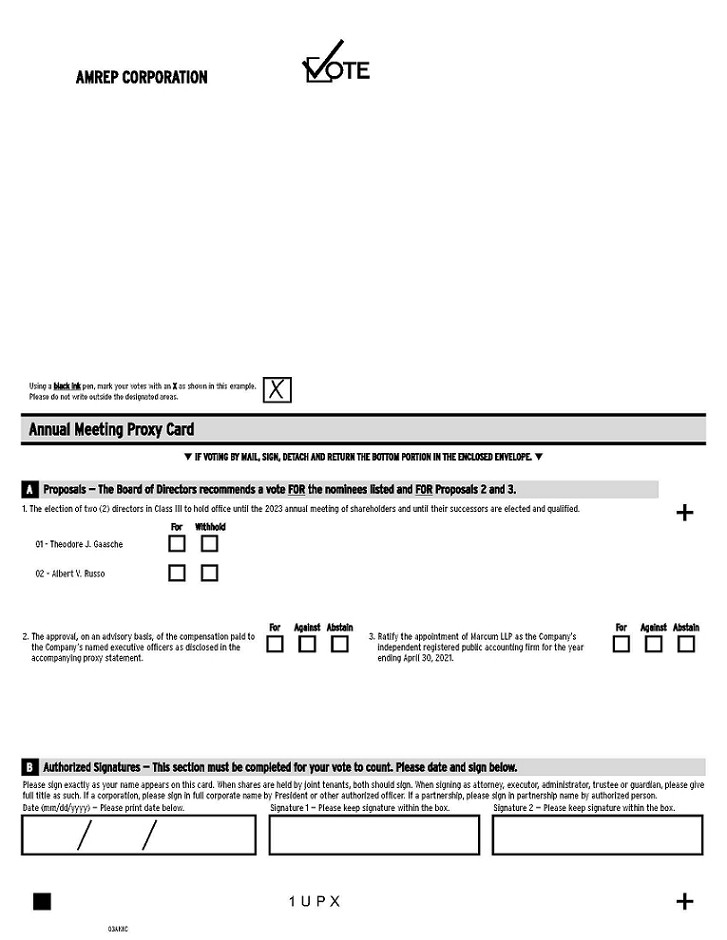

(1) To elect two directorsone director in Class IIIII to hold office until the 20232025 annual meeting of shareholders and until their successors arehis successor is elected and qualified;

(2) To approve, on an advisory basis, the compensation paid to the Company’s named executive officers as disclosed in the accompanying proxy statement; and

(3) To ratify the appointment of Marcum LLP as the Company’s independent registered public accounting firm for fiscal year 2021; and

(4) To consider and act upon such other business as may properly come before the meeting.

In accordance with the Company’s By-Laws, the Board of Directors has fixed the close of business on July 20, 202018, 2022 as the record date for the determination of shareholders of the Company entitled to notice of and to vote at the meeting and any continuation or adjournment thereof. The list of such shareholders will be available for inspection by shareholders during the ten days prior to the meeting at the offices of the Company, 620850 West GermantownChester Pike, Suite 175, Plymouth Meeting,205, Havertown, Pennsylvania 19462.19083.

Whether or not you expect to be present at the meeting, please mark, date and sign the enclosed proxy card and return it to the Company in the self-addressed envelope enclosed for that purpose. The proxy is revocable and will not affect your right to vote in person in the event you attend the meeting.

The accompanying proxy statement is dated July 31, 2020,August 1, 2022, and, together with the enclosed proxy card, is first being mailed to the shareholders of the Company on or about July 31, 2020.August 1, 2022.

| By Order of the Board of Directors | |

| Christopher V. Vitale, President, Chief Executive Officer and Secretary |

| Dated: | |

| Havertown, Pennsylvania |

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on September 10, 20208, 2022

The Proxy Statement and Annual Report to Shareholders are available at http:https://www.edocumentview.com/axr.amrepcorp.com/static.

Upon the written request of any shareholder of the Company, the Company will provide to such shareholder a copy of the Company’s annual report on Form 10-K for the year ended April 30, 2020, including the financial statements, filed with the Securities and Exchange Commission. Any request should be directed to AMREP Corporation, 620 West Germantown Pike, Suite 175, Plymouth Meeting, Pennsylvania 19462, Attention: Corporate Secretary. There will be no charge for such report unless one or more exhibits thereto are requested, in which case the Company’s reasonable expenses of furnishing exhibits may be charged.

| Upon the written request of any shareholder of the Company, the Company will provide to such shareholder a copy of the Company’s annual report on Form 10-K for the year ended April 30, 2022, including the financial statements, filed with the Securities and Exchange Commission. Any request should be directed to AMREP Corporation, 850 West Chester Pike, Suite 205, Havertown, Pennsylvania 19083, Attention: Corporate Secretary. There will be no charge for such report unless one or more exhibits thereto are requested, in which case the Company’s reasonable expenses of furnishing exhibits may be charged. |

AMREP CORPORATION620

850 West GermantownChester Pike, Suite 175Plymouth Meeting,205

Havertown, Pennsylvania 1946219083

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To be Held at 9:00 A.M. Eastern Time on September 10, 20208, 2022

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of AMREP Corporation (the “Company”) for use at the Annual Meeting of Shareholders of the Company to be held on September 10, 2020,8, 2022, and at any continuation or adjournment thereof (the “Annual Meeting”). The Annual Meeting will be held at the Conference CenterFairfield Inn & Suites at 660 West Germantown Pike, Plymouth Meeting,100 Lawrence Road, Broomall, Pennsylvania 19462.19008.

The Annual Report of the Company on Form 10-K for the fiscal year ended April 30, 20202022 filed on July 27, 202021, 2022 with the Securities and Exchange Commission is included in this mailing but does not constitute a part of the proxy solicitation material. This Proxy Statement and the accompanying Notice of 20202022 Annual Meeting of Shareholders and proxy card are first being sent to shareholders on or about July 31, 2020.August 1, 2022. All references in this Proxy Statement to fiscal 20202022 and fiscal 20192021 mean the Company’s fiscal years ended April 30, 20202022 and 2019.2021.

QUESTIONS AND ANSWERS CONCERNING THE ANNUAL MEETING

What will be voted on at the Annual Meeting?

There are threetwo matters scheduled for a vote:

| · | Proposal Number 1: Election of |

| · | Proposal Number 2: Approval, on an advisory basis, of the compensation paid to the Company’s named executive officers as disclosed in this Proxy |

What if another matter is properly brought before the Annual Meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How does the Board recommend I vote on the proposals?

The Board recommends that you vote:

| · | “For” the election as |

| · | “For” the approval, on an advisory basis, of the compensation paid to the Company’s named executive officers as disclosed in this Proxy |

Who is entitled to vote at the Annual Meeting?

Only shareholders of record as of the close of business on July 20, 2020,18, 2022, the date fixed by the Board in accordance with the Company’s By-Laws, are entitled to notice of and to vote at the Annual Meeting.

If I have given a proxy, how do I revoke that proxy?

Anyone giving a proxy may revoke it at any time before it is exercised by giving the Secretary of the Company written notice of the revocation, by submitting a proxy bearing a later date or by attending the Annual Meeting and voting.

How will my proxy be voted?

All properly executed, unrevoked proxies in the enclosed form that are received in time will be voted in accordance with the shareholders’ directions and, unless contrary directions are given, will be voted “For” the election as directorsdirector of the two nomineesnominee named in this Proxy Statement and “For” the approval, on an advisory basis, of the compensation paid to the Company’s named executive officers as disclosed in this Proxy Statement and “For” the ratification of the appointment of Marcum LLP as the Company’s independent registered public accounting firm for fiscal year 2021 and, if any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

What if athe nominee is unwilling or unable to serve?

This is not expected to occur but, in the event that it does, proxies will be voted for a substitute nominee designated by the Board or, in the discretion of the Board, the position may be left vacant.

What are “broker non-votes”?

Under the rules that govern brokers, if brokers or nominees who hold shares in “street name” on behalf of beneficial owners do not have instructions on how to vote on matters deemed by the New York Stock Exchange to be “non-routine” (which include Proposal Numbers 1 and 2 in this Proxy Statement), a broker non-vote of those shares will occur, which means the shares will not be voted on such matters. If your shares are held in “street name,” you must cast your vote or instruct your nominee or broker to do so if you want your vote to be counted with respect to Proposal Numbers 1 and 2 in this Proxy Statement. Proposal Number 3 relating to the ratification of the appointment of Marcum LLP as the Company’s independent registered public accounting firm for fiscal year 2021 is a matter on which brokers or nominees who hold shares in “street name” on behalf of beneficial owners who have not been given specific voting instructions are allowed to vote such shares.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count votes as follows:

| · | for Proposal Number 1 (for the election of |

| · | for Proposal Number 2 (approval, on an advisory basis, of the compensation paid to the Company’s named executive officers as disclosed in this Proxy Statement), votes “For” and “Against,” abstentions and broker non-votes. Abstentions are treated as shares present and entitled to vote on Proposal Number 2 and, therefore, will have the same effect as a vote “Against” Proposal Number |

- 2 -

Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

How many votes are needed to approve each proposal?

| · | With respect to Proposal Number 1 (for the election of |

| · | Proposal Number 2 (approval, on an advisory basis, of the compensation paid to the Company’s named executive officers as disclosed in this Proxy Statement) must receive “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote in order to be approved. |

- 2 -

How many shares can be voted at the Annual Meeting?

As of July 20, 2020,18, 2022, the Company had issued and outstanding 8,141,9045,254,909 shares of common stock, par value $.10 per share (“Common Stock”). Each share of Common Stock is entitled to one vote on matters to come before the Annual Meeting.

How many votes will I be entitled to cast at the Annual Meeting?

You will be entitled to cast one vote for each share of Common Stock you held at the close of business on July 20, 2020,18, 2022, the record date for the Annual Meeting, as shown on the list of shareholders at that date prepared by the Company’s transfer agent for the Common Stock.

What is the deadline for voting?

If you are a shareholder of record and you choose to cause your shares to be voted by completing, signing, dating and returning the enclosed proxy card, your proxy card must be received before the Annual Meeting in order for your shares to be voted at the Annual Meeting.

If you hold your shares in street name, please comply with the deadline for submitting voting instructions provided by the broker, bank or other nominee that holds your shares.

What is a “quorum?”

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock of the Company authorized to vote will constitute a quorum for the transaction of business at the Annual Meeting. Abstentions will be counted in determining whether a quorum is present at the Annual Meeting. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting. A quorum must be present at the beginning of the Annual Meeting in order to transact business at the Annual Meeting.

- 3 -

Who may attend the Annual Meeting?

All shareholders of the Company who owned shares of record at the close of business on July 20, 202018, 2022 may attend the Annual Meeting. If you want to vote in person and you hold Common Stock in street name (i.e., your shares are held in the name of a broker, dealer, custodian bank or other nominee), you must obtain a proxy card issued in your name from the firm that holds your shares and bring that proxy card to the Annual Meeting, together with a copy of a statement from that firm reflecting your share ownership as of the record date, and valid identification. If you hold your shares in street name and want to attend the Annual Meeting but not vote in person, you must bring to the Annual Meeting a copy of a statement from the firm that holds your shares reflecting your share ownership as of the record date and valid identification.

Where can I find the voting results of the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be tallied by the inspector of election after the taking of the vote at the Annual Meeting. The Company will publish the final voting results in a Current Report on Form 8-K, which the Company is required to file with the Securities and Exchange Commission.

- 43 -

COMMON STOCK OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Set forth in the following table is information concerning the beneficial ownership, as defined in Rule 13d-3 under the Securities Exchange Act of 1934, as amended, of Common Stock by the persons who, to the knowledge of the Company, own beneficially more than 5% of the outstanding shares. The table also sets forth the same information concerning beneficial ownership for each director of the Company, each named executive officer of the Company, and all directors and named executive officers of the Company as a group. Unless otherwise indicated, (i) reported ownership is as of July 20, 202018, 2022 and (ii) the Company understands that the beneficial owners have sole voting and investment power with respect to the shares beneficially owned by them. In the case of directors and executive officers, the information below has been provided by such persons at the request of the Company.

| Name of Beneficial Owner | Shares of Common Stock Beneficially Owned | Percent of Class (%) | Shares of Common Stock Beneficially Owned | Percent of Class (%) | ||||||||||||

| Nicholas G. Karabots, et al | 2,096,061 | (1) | 25.7 | % | ||||||||||||

| Michael Melby, Gate City Capital Management, LLC | 1,455,649 | (2) | 17.9 | % | ||||||||||||

| Albert V. Russo (Director), Clifton Russo, Lawrence Russo, Pasha Funding, LLC | 1,286,278 | (3) | 15.8 | % | 1,291,763 | (1) | 24.5 | % | ||||||||

| Heinrich Bauer (USA) LLC | 730,488 | (4) | 9.0 | % | ||||||||||||

| James H. Dahl and Rainey E. Lancaster | 707,011 | (2) | 13.5 | % | ||||||||||||

| Robert E. Robotti (Director), et al | 526,959 | (5) | 6.5 | % | 516,932 | (3) | 9.8 | % | ||||||||

| Michael Melby and Gate City Capital Management, LLC | 358,416 | (4) | 6.8 | % | ||||||||||||

| Other Directors and Named Executive Officers | ||||||||||||||||

| Edward B. Cloues, II | 20,499 | (6) | * | 43,261 | (5) | * | ||||||||||

| Theodore J. Gaasche | 20,094 | (7) | * | |||||||||||||

| Christopher V. Vitale | 80,000 | (8) | * | 94,000 | (6) | 1.8 | % | |||||||||

| Adrienne M. Uleau | 3,000 | (9) | * | 7,600 | (7) | * | ||||||||||

| James M. McMonagle | 3,500 | * | ||||||||||||||

| Directors and Named Executive Officers as a Group (7 persons) | 1,940,330 | 23.7 | % | |||||||||||||

| Directors and Named Executive Officers as a Group (5 persons) | 1,953,556 | 36.8 | % | |||||||||||||

* Indicates less than 1%.

| (1) |

- 5 -

| Other than the number of deferred common share units owned by Mr. Albert V. Russo, the information in the table and in this footnote is based solely on information received from Mr. Albert V. Russo. Albert V. Russo, Clifton Russo, Lawrence Russo and Pasha Funding, LLC, each c/o Albert V. Russo, 401 Broadway, New York, |

| (2) | The information in the table and this footnote is based solely on Amendment No. |

- 4 -

| (3) | Other than the number of deferred common share units owned by Mr. Robotti, the information in the table and in this footnote is based solely on information received from Mr. Robotti. The following table sets forth information regarding the beneficial ownership of Common Stock by Robert E. Robotti, Robotti & Company, Incorporated (“R&CoI”), Robotti Securities, LLC (“RS”) and Robotti & Company Advisors, LLC (“R&CoA”), |

- 6 -

| Beneficial Owner | Shares Owned Beneficially | |||

| Robert E. Robotti | 516,932 | (a),(b),(c),(d),(e) | ||

| R&CoI | 500,249 | (a),(b) | ||

| RS | 3,040 | (a) | ||

| R&CoA | 497,209 | (b) | ||

| Kenneth R. Wasiak | 284,753 | (c),(d) | ||

| RMC | 284,753 | (c),(d) | ||

| RIC | 155,550 | (c) | ||

| RI | 129,203 | (d) | ||

| (a) | Each of Mr. Robotti and R&CoI share with RS the power to vote or direct the vote, and the power to dispose or direct the disposition, of |

| (b) | Each of Mr. Robotti and R&CoI share with R&CoA the power to vote or to direct the vote, and the power to dispose or direct the disposition, of |

| (c) | Each of RMC and Messrs. Robotti and Wasiak share with RIC the power to vote or direct the vote, and the power to dispose or direct the disposition, of 155,550 shares of Common Stock owned by RIC. |

| (d) | Each of RMC and Messrs. Robotti and Wasiak share with RI the power to vote or to direct the vote, and the power to dispose or direct the disposition, of 129,203 shares of Common Stock owned by RI. |

| (e) | Includes |

| The information in the table and this footnote is based solely on information received from Michael Melby and Gate City Capital Management, LLC. The principal address of Michael Melby and Gate City Capital Management, LLC is 8725 W. Higgins Road, Suite 530, Chicago, Illinois 60631. Michael Melby and Gate City Capital Management, LLC have the sole power to vote or to direct the vote of 178,027 shares of Common Stock. Michael Melby and Gate City Capital Management, LLC have the sole power to dispose or to direct the disposition of 358,416 shares of Common Stock. |

- 5 -

| (5) | Includes |

| Includes |

beneficially owned by Mr. Vitale does not include 50,000 shares of Common Stock that may be purchased pursuant to a stock option that will become exercisable on November 1, 2026 if Mr. Vitale is employed by, or providing service to, the Company on such date. |

| Includes 833 restricted shares of Common Stock that will vest on July 7, 2023, 700 restricted shares of Common Stock that will vest on July 13, 2023, 1,000 restricted shares of Common Stock that will vest on July 15, |

- 76 -

PROPOSAL NUMBER 1

ELECTION OF DIRECTORSDIRECTOR

The Board is a classified board divided into three classes – Class I, Class II and Class III. Class III and IIIII each consists of one director and Class IIII consists of two directors. Each director serves for a term expiring at the annual meeting of shareholders held in the third year following the year of his election and until his successor is elected and qualified. At this Annual Meeting, twoone Class III directorsII director will be elected to serve until the 20232025 annual meeting of shareholders and until their successors arehis successor is elected and qualified, except in the event of any such director’s earlier death, resignation or removal. The terms of office of the Class IIII and Class III directors will expire at the annual meetings of shareholders to be held in 20212023 and 2022,2024, respectively, upon the election and qualification of their successors, except in the event of any such director’s earlier death, resignation or removal.

At the recommendation of its Nominating and Corporate Governance Committee, the Board is nominating Theodore J. Gaasche and Albert V. Russo,Robert E. Robotti, who areis the incumbent Class III directors,II director, for reelectionelection at the Annual Meeting. Although the Board does not expect that either of the persons nominatedMr. Robotti will be unable to serve as a director, should either of themhe become unavailable it is intended that the shares represented by proxies in the accompanying form will be voted for the election of a substitute nominee or nominees designated by the Board or, in the discretion of the Board, the position or positions may be left vacant.

The Company believes that its directors have the qualifications and skills necessary to serve as directors of the Company. The following information relates to the nomineesnominee of the Board for election and the other directors of the Company.

NomineesNominee to serve until the 2025 Annual Meeting of Shareholders (Class II):

ROBERT E. ROBOTTI, age 69, has been a director of the Company since September 2016. Mr. Robotti has been the president of Robotti & Company Advisors, LLC (a registered investment advisor) and Robotti Securities, LLC, FKA Robotti & Company, LLC (a registered broker-dealer), and their predecessors, since 1983. He has been the managing member of Ravenswood Management Company, LLC (and its predecessor) since 1980, which serves as the general partner of The Ravenswood Investment Company, L.P. and Ravenswood Investments III, L.P. He currently serves as a director and Chairman of the Board of Pulse Seismic Inc., a seismic data licensing business, and has held these positions for more than the past five years. Mr. Robotti has also served as a director of PrairieSky Royalty Ltd., a petroleum and natural gas royalty-focused company, since October 2019 and of Tidewater Inc., an owner and operator of offshore support vessels providing offshore energy transportation services, since June 2021. Mr. Robotti was a director of PHX Minerals Inc. (formerly known as Panhandle Oil and Gas Inc.), a diversified mineral company, from 2004 to May 2020 and a director of BMC Building Materials Holding Corporation from 2012 to 2015. Mr. Robotti was a member of the SEC’s Advisory Committee of Smaller Public Companies from 2005 to 2006 and also served on its corporate governance subcommittee. He has both a BSBA and an MBA in Accounting and was a certified public accountant earlier in his career, which license is currently inactive. Mr. Robotti’s qualifications to serve on the Board include his extensive experience in the investment business as the founder, chief executive officer, chairman and controlling owner of a registered investment advisor and a registered broker-dealer, and their predecessors, and as the manager of several investment partnerships. Additionally, he brings to the Board a broad understanding of governance, audit and compensation issues as a result of his service on several other public company boards.

Director continuing in office until the 2023 Annual Meeting of Shareholders (Class III)::

THEODORE J. GAASCHE, age 58, has been a director of the Company since 2013. Mr. Gaasche was a consultant for Spartan Organization, Inc., a private company that advises various print, publishing and other portfolio companies, from February 2017 to October 2017 and during that period served as a director of certain entities related to Spartan Organization, Inc. Mr. Gaasche was the Executive Vice President, Operations of Spartan Organization, Inc. from 2013 to January 2017. Mr. Gaasche was the President and Chief Executive Officer of the Company from 2011 to 2013. For over twenty years until 2008, Mr. Gaasche held positions of increasing responsibility at various divisions of SunGard Data Systems Inc., most recently as the Chief Executive Officer of SunGard Availability Services, a division of SunGard that provided disaster recovery, managed information technology and related services. Mr. Gaasche brings to the Board his extensive business experience, including his knowledge of the Company as its prior President and Chief Executive Officer.

ALBERT V. RUSSO, age 66,68, has been a director of the Company since 1996. Mr. Russo is the Managing Partner of real estate entities 401 Broadway Building, Russo Associates and Pioneer Realty and has held these positions for more than the past five years. Mr. Russo has been involved in the ownership and management of commercial real estate for more than 25 years and contributes to the Board his specialized knowledge of the real estate business.

- 87 -

DirectorDirectors continuing in office until the 20212024 Annual Meeting of Shareholders (Class I):

EDWARD B. CLOUES, II, age 72,74, has been a director of the Company since 1994 and currently serves as the Chairman of the Board. Mr. Cloues has served as Chairman of the Board of Trustees of Virtua Health, Inc. (“Virtua”), a non-profit hospital and healthcare system, since January 2022, and since 2010 held various positions on the Board of Trustees of Virtua. He served as a director of Hillenbrand, Inc., a diversified global industrial company, since 2010.from 2010 to February 2021. Mr. Cloues also serves as the Vice Chairman of the Board of Trustees of Virtua Health, Inc., a non-profit hospital and healthcare system, where he chairs the Finance and Investment Committee, is a member of the Compensation Committee and the Executive/Strategy Committee and is a member and past Chairman of the Audit Committee. He served as Chairman of the Board of Penn Virginia Corporation, an oil and gas exploration and development company, from 2011 to September 2016 and as the interim Chief Executive Officer of Penn Virginia Corporation from October 2015 to September 2016 during the Board-led reorganization of that company, including a chapter 11 filing under the U.S. Bankruptcy Code in May 2016 and the emergence from chapter 11 in September 2016 pursuant to a confirmed plan of reorganization. He also served as a director (since 2003) and Chairman of the Board (since 2011) of PVR GP, LLC, the General Partner of PVR Partners, L.P., a pipeline and natural resources master limited partnership, until its sale in 2014. Mr. Cloues was also a director, the Chairman of the Board and the Chief Executive Officer of K-Tron International, Inc., a material handling equipment manufacturer, from 1998 until its sale in 2010. Prior to 1998, Mr. Cloues was a law firm partner at a major global law firm where he specialized in mergers and acquisitions and other business law matters. That law firm experience combined with the experience gained from his former 12 year chief executive position with K-Tron International, Inc., which had been publicly held prior to its sale, has given him a strong background in dealing with complex business transactions and general management issues. Additionally, he brings to the Board a broad understanding of governance, audit and compensation issues as a result of his service on several other public company boards.

Director continuing in office until the 2022 Annual Meeting of Shareholders (Class II):

ROBERT E. ROBOTTICHRISTOPHER V. VITALE, age 67,46, has been the president of Robotti & Company Advisors, LLC (a registered investment advisor) and Robotti Securities, LLC, FKA Robotti & Company, LLC (a registered broker-dealer), and their predecessors, since 1983. He has been the managing member of Ravenswood Management Company, LLC (and its predecessor) since 1980, which serves as the general partner of The Ravenswood Investment Company, L.P. and Ravenswood Investments III, L.P. Mr. Robotti served as a portfolio manager of Robotti Global Fund, LLC, a global equity fund, from 2007 to March 2015. Mr. Robotti has served as a director of PrairieSky Royalty Ltd.the Company since 2021 and has been President and Chief Executive Officer of the Company since September 2017. From 2014 to September 2017, Mr. Vitale was Executive Vice President, Chief Administrative Officer and General Counsel of the Company and, from 2013 to 2014, he was Vice President and General Counsel of the Company. Prior to joining the Company, Mr. Vitale held various legal positions at Franklin Square Holdings, L.P., a petroleumnational sponsor and natural gas royalty-focused company, since 2019. He also serves as a directordistributor of investment products, from 2011 to 2013 and Chairman of the Board of Pulse Seismicat WorldGate Communications, Inc., a seismic data licensing business,provider of digital voice and has held these positions for more thanvideo phone services and video phones, from 2009 to 2011. Prior to joining WorldGate, Mr. Vitale was an attorney with the past five years.law firms of Morgan, Lewis & Bockius LLP and Sullivan & Cromwell LLP. Mr. Robotti was a director of Panhandle Oil & Gas Company, a diversified mineral company, from 2004 to May 2020 and a director of BMC Building Materials Holding Corporation from 2012 to December 2015. Mr. Robotti was a member of the SEC’s Advisory Committee of Smaller Public Companies from 2005 to 2006 and also served on its corporate governance subcommittee. He has an MBA in Accounting and was a certified public accountant earlier in his career, which license is currently inactive. Mr. Robotti’sVitale’s qualifications to serve on the Board include his extensivein-depth knowledge of the Company in connection with his position as President and Chief Executive Officer of the Company, and his law firm and in-house legal experience has given him a strong background in the investment business as the founder, chief executive officer, chairmanboard and controlling owner of a registered investment advisor and a registered broker-dealer, and their predecessors, and as the manager of several investment partnerships. Additionally, he brings to the Board a broad understanding of governance audit and compensation issues, as a result of his service on several other public company boards.well as securities and complex business transactions.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE TWO CLASS III NOMINEES.II NOMINEE.

- 98 -

PROPOSAL NUMBER 2

ADVISORY VOTE ON THE COMPENSATION PAID TO THE COMPANY’S NAMED EXECUTIVE OFFICERS

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and Section 14A of the Securities Exchange Act of 1934, as amended, the Company’s shareholders are entitled to vote to approve, on an advisory basis, the compensation paid to the Company’s named executive officers as disclosed in this Proxy Statement in accordance with the rules of the Securities and Exchange Commission. The compensation paid to the Company’s named executive officers subject to the vote is disclosed in the compensation table and related narrative disclosure contained in this Proxy Statement.

The Board is asking the shareholders to indicate their support for the compensation paid to the Company’s named executive officers as described in this Proxy Statement by casting a non-binding advisory vote “For” the following resolution:

“RESOLVED, that the shareholders of AMREP Corporation hereby APPROVE, on a nonbinding advisory basis, the compensation paid to the Company’s named executive officers, as disclosed in the Company’s proxy statement for the 20202022 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the executive compensation table and narrative discussion disclosed therein.”

Because the vote is advisory, it is not binding on the Board or the Company. In accordance with the Dodd-Frank Act, the vote to approve the compensation of the Company’s named executive officers shall not be construed: (i) as overruling any decision by the Company or the Board; (ii) to create or imply any change in the fiduciary duties of the Company or the Board; or (iii) to create or imply any additional fiduciary duties for the Company or the Board. Nevertheless, the views expressed by the shareholders, whether through this vote or otherwise, are important to management and the Board and, accordingly, the Board and the Compensation and Human Resources Committee intend to consider the results of this vote in making determinations in the future regarding executive compensation arrangements.

At the most recent annual meeting of shareholders held on September 12, 2019, the Company’s shareholders voted to approve, on an advisory basis, the compensation paid to the Company’s named executive officers as disclosed in the proxy statement for that meeting dated August 2, 2019. Nevertheless, the Company did receive a significant number of votes against approving this compensation, primarily from the Company’s largest beneficial shareholder. The Chairman of the Compensation and Human Resources Committee reached out to this shareholder to receive feedback and better understand the reasons for the negative vote. In response, the shareholder’s expressed reasons for the negative vote were his belief that the amounts paid to the Company’s named executive officers were in excess of the amounts he believed appropriate, including his belief that the issuance of restricted shares of Common Stock should not be a component of executive compensation, and his general dissatisfaction with the overall direction of the Company and its overhead cost structure. With respect to these objections, the Company notes that it had only three named executive officers in fiscal 2019, that their fiscal 2019 annual salaries ranged from $197,000 to $318,000, that no bonus was paid to any named executive officers except for one $10,000 bonus and that an aggregate of 29,200 restricted shares of Common Stock were issued to the Company’s named executive officers in fiscal 2019.

- 10 -

Advisory approval of this proposal requires the affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote on this matter at the Annual Meeting.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE COMPENSATION PAID TO THE COMPANY’S NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT.

- 119 -

PROPOSAL NUMBER 3

RATIFICATION OF APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors of the Company has appointed the firm of Marcum LLP, certified public accountants, as the independent registered public accounting firm to make an examination of the consolidated financial statements of the Company for its fiscal year ending April 30, 2021, and the Board of Directors and the Audit Committee recommend that the shareholders ratify this appointment. Marcum LLP served as the independent registered public accounting firm of the Company for the fiscal year ended April 30, 2020. A representative of Marcum LLP is expected to be present at the Annual Meeting with the opportunity to make a statement if he or she desires to do so and to be available to respond to appropriate questions.

While shareholder ratification of the appointment of the Company’s independent registered public accounting firm is not required, the Company values the opinions of its shareholders and believes that shareholder ratification of the appointment of the Company’s independent registered public accounting firm is a good corporate governance practice. If a majority of the votes cast at the Annual Meeting are against ratification of Marcum LLP, the Audit Committee will reconsider whether to retain Marcum LLP and may retain that firm or another firm without resubmitting the matter to the Company’s shareholders. If the shareholders fail to ratify the selection, the Audit Committee will seek to understand the reasons that the shareholders did not ratify its selection of Marcum LLP. The Audit Committee will be under no obligation, however, to select a new independent auditor. Even if the appointment is ratified, the Audit Committee may, in its discretion, direct the appointment of a different independent auditor at any time during the year if it determines that such change would be in the Company’s best interests and in the best interests of the Company’s shareholders.

Audit Fees

The following table sets forth certain information concerning the fees of Marcum LLP for fiscal years 2020 and 2019. The reported fees, except the Audit Fees, are amounts billed to the Company in the indicated fiscal years. The Audit Fees are for services for those fiscal years.

| Fiscal Year Ended April 30, | ||||||||

| 2020 | 2019 | |||||||

| Audit Fees(1) | $ | 142,192 | $ | 166,216 | ||||

| Audit-Related Fees(2) | 2,575 | 21,775 | ||||||

| Tax Fees(3) | - | - | ||||||

| All Other Fees | - | - | ||||||

| Total | $ | 144,767 | $ | 187,991 | ||||

- 12 -

Pre-Approval Policies and Procedures

The Audit Committee pre-approves all audit services to be provided by the independent registered public accounting firm and, separately, all permitted non-audit services to be performed by the independent registered public accounting firm.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF MARCUM LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2021.

- 13 -

THE BOARD OF DIRECTORS AND ITS COMMITTEES

Governance Standards

The Company’s Common Stock is listed on the New York Stock Exchange, and the Company is subject to the New York Stock Exchange’s Corporate Governance Standards (the “Governance Standards”). The Governance Standards, among other things, generally require a listed company to have independent directors within the meaning of the Governance Standards as a majority of its board of directors and for the board to have a nominating/corporate governance committee, an audit committee and a compensation committee, each composed entirely of independent directors.

Based principally on their responses to questions to these persons regarding the relationships addressed by the Governance Standards and discussions with them, the Board has determined that other than his service as a director, each of Edward B. Cloues, II, Theodore J. Gaasche, Robert E. Robotti and Albert V. Russo has no material relationship with the Company, either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company, and, therefore, meets the director independence requirements of the Governance Standards.

As required by the Governance Standards, the Board has adopted Corporate Governance Guidelines (the “Guidelines”) that address various matters involving the Board and the conduct of its business. The Board has also adopted a Code of Business Conduct and Ethics setting forth principles of business conduct applicable to the directors, officers and employees of the Company. The Guidelines and Code of Business Conduct and Ethics, as well as the charters of the Board’s Nominating and Corporate Governance Committee, Audit Committee and Compensation and Human Resources Committee, may be viewed under “Corporate Governance” on the Company’s website at www.amrepcorp.com, and written copies will be provided to any shareholder upon written request to the Company at AMREP Corporation, 620850 West GermantownChester Pike, Suite 175, Plymouth Meeting,205, Havertown, Pennsylvania 19462,19083, Attention: Corporate Secretary. The Company intends to disclose on its website any amendment to or waiver of any provision of the Code of Business Conduct and Ethics that applies to its principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The Company’s Insider Trading Policy, which applies to all employees and directors, includes, among other provisions, a prohibition of any hedging or monetization transactions involving the Company’s securities.

Directors are expected to attend Annual Meetings of Shareholders, and allShareholders. Due to the COVID-19 pandemic, none of the directors attended last year’s Annual Meeting.Meeting other than Mr. Vitale. The Board held sixfive meetings during the last fiscal year. All of the directors attended all of the meetings held during the last fiscal year of the Board and its Committees of which they were members. Pursuant to the Guidelines, the Board has established a policy that the non-management directors meet in executive session at least twice per year and that the independent directors also meet in executive session at least twice per year. The Chairman of the Board (currently, Edward B. Cloues, II), if in attendance, will be the presiding director at each such executive session; otherwise, those attending may select a presiding director.

Any shareholder or other interested person wishing to communicate with the Board or any of the directors may send a letter addressed to the member or members of the Board to whom the communication is directed in care of AMREP Corporation, 620850 West GermantownChester Pike, Suite 175, Plymouth Meeting,205, Havertown, Pennsylvania 19462,19083, Attention: Corporate Secretary. All such communications will be forwarded to the specified addressee(s).

- 14 -

Nominating and Corporate Governance Committee

The Board has a Nominating and Corporate Governance Committee that operates under a written charter adopted by the Board. Each member of the Nominating and Corporate Governance Committee is required to be an independent director, as defined by the Governance Standards. The members of this Committee are Messrs. Cloues (Chairman), Robotti and Russo, each of whom has been determined by the Board to be an independent director within the meaning of the Governance Standards. This Committee reports regularly to the Board concerning its activities. The Nominating and Corporate Governance Committee held three meetingsone meeting during the last fiscal year.

- 10 -

The duties of the Nominating and Corporate Governance Committee include identifying individuals the Committee considers qualified to be elected Board members consistent with criteria approved by the Board, and recommending persons to be nominated by the Board for election by the shareholders. When considering a nominee for election as a director, the Committee considers the experience, skills and knowledge of business and management practices a candidate may possess and the perspective he or she may bring to the Board, and employs criteria calling for, among other things, personal and professional integrity, good judgment, a high level of ability and business acumen, and experience in the Company’s industries, as well as the ability of the nominee to devote sufficient time to performing his or her duties on the Board in an effective manner. Although the Committee has no specific policy regarding the diversity of the membership of the Board, it is the objective of the Committee that the Board be comprised of persons of diverse backgrounds such that as a unit the members of the Board will possess the necessary skills to appropriately discharge their responsibilities as the Company’s directors. The Committee is also responsible for periodically reviewing and recommending changes to the Guidelines and for overseeing the Company’s corporate governance practices.

The Nominating and Corporate Governance Committee will consider candidates for director recommended by shareholders on the same basis as any other proposed nominees. Any shareholder desiring to propose a candidate for selection as a nominee of the Board for election at the 20212023 Annual Meeting of Shareholders may do so by sending a written communication no later than May 1, 20212023 to the Nominating and Corporate Governance Committee, AMREP Corporation, 620850 West GermantownChester Pike, Suite 175, Plymouth Meeting,205, Havertown, Pennsylvania 19462,19083, Attention: Corporate Secretary, identifying the proposing shareholder, specifying the number of shares of Common Stock held by such shareholder and stating the name and address of the proposed nominee and the information concerning such person that the regulations of the Securities and Exchange Commission require be included in a proxy statement relating to such person’s proposed election as a director.

Audit Committee

The Board has an Audit Committee that operates under a written charter adopted by the Board. Each member of the Audit Committee is required to be an independent director, as defined by the Governance Standards. The members of this Committee are Messrs. Cloues (Chairman), Robotti and Russo, each of whom has been determined by the Board to be an independent director within the meaning of the Governance Standards. The Board has also determined that Mr. Robotti qualifies as an audit committee financial expert within the meaning of Securities and Exchange Commission regulations. This Committee reports regularly to the Board concerning its activities. The Audit Committee held five meetings during the last fiscal year.

The duties of the Audit Committee include (i) appointing the Company’s independent registered public accounting firm, approving the services to be provided by that firm and its compensation and reviewing that firm’s independence and performance of services, (ii) reviewing the scope and results of the yearly audit by the independent registered public accounting firm, (iii) reviewing the Company’s system of internal controls and procedures, (iv) reviewing with management and the independent registered public accounting firm the Company’s annual and quarterly financial statements, (v) reviewing the Company’s financial reporting and accounting standards and principles and (vi) overseeing the administration and enforcement of the Company’s Code of Business Conduct and Ethics. In addition to the Audit Committee’s responsibilities set forth above, the Audit Committee has, pursuant to its charter, primary responsibility for the oversight of risks that could affect the Company.

- 1511 -

Compensation and Human Resources Committee

The Board has a Compensation and Human Resources Committee that operates under a written charter adopted by the Board. Each member of the Compensation and Human Resources Committee is required to be an independent director, as defined by the Governance Standards. The members of this Committee are Messrs. Robotti (Chairman), Cloues and Russo, each of whom has been determined by the Board to be an independent director within the meaning of the Governance Standards. This Committee reports regularly to the Board concerning its activities. During the last fiscal year, the Compensation and Human Resources Committee held twofour meetings.

The Compensation and Human Resources Committee is responsible for reviewing and approving corporate goals and objectives applicable to the Company’s chief executive officer and determining his compensation and that of the Company’s other executive officers and making recommendations to the Board concerning other matters relating to executive officer and director compensation. With respect to salaries, bonuses and other compensation and benefits, the decisions and recommendations of the Compensation and Human Resources Committee are subjective and are not based on any list of specific criteria. In the past, factors influencing the Committee’s decisions regarding executive salaries have included the Committee’s assessment of the executive’s performance and any changes in functional responsibility. In determining the salary to be paid to a particular individual, the Committee applies these and other criteria, while also using its best judgment of compensation applicable to other executives holding comparable positions both within the Company and at other companies. Executive officers of the Company do not play a role in determining their compensation. Neither the Board nor the Committee has engaged compensation consultants for the purposes of determining or advising upon executive or director compensation.

Risk Oversight

The Board is actively involved in risk oversight and management of risk. The Board has ultimate responsibility for the oversight of risks facing the Company and for the management of those risks, including overseeing cybersecurity and other information technology security matters, with the Audit Committee conducting preliminary evaluations of risk and addressing risk prior to review by the Board. The Audit Committee considers and reviews with management the Company’s internal control processes. The Audit Committee also considers and reviews with the Company’s independent registered public accounting firm the adequacy of the Company’s internal controls, including the processes for identifying significant risks or exposures, and elicits recommendations for the improvement of such procedures where needed. In addition to the Audit Committee’s role, the full Board is involved in the oversight and administration of risk and risk management practices by overseeing members of senior management in their risk management capacities. Members of the Company’s senior management have day-to-day responsibility for risk management and establishing risk management practices, and members of management are expected to report matters relating specifically to the Audit Committee directly thereto, and to report all other matters directly to the Chairman of the Board or the Board as a whole. Members of the Company’s senior management have an open line of communication to the Chairman of the Board and the Board as a whole and have the discretion to raise issues from time-to-time in any manner they deem appropriate, and management’s reporting on issues relating to risk management typically occurs through direct communication with directors, the Chairman of the Board or the Audit Committee as matters requiring attention arise.

- 16 -

In furtherance of its risk oversight responsibilities, the Board has evaluated the Company’s overall compensation policies and practices for its employees to determine whether such policies and practices create incentives that could reasonably be expected to affect the risks faced by the Company and its management, has further assessed whether any risks arising from these policies and practices are reasonably likely to have a material adverse effect on the Company, and has concluded that the risks arising from the Company’s policies and practices are not reasonably likely to have a material adverse effect on the Company.

- 12 -

No Material Proceedings

As of July 31, 2020,August 1, 2022, there are no material proceedings to which any director, executive officer or affiliate of the Company or any owner of more than five percent of the Common Stock, or any associate of any of the foregoing, (i) is a party adverse to the Company or any of its subsidiaries or (ii) has a material interest adverse to the Company or any of its subsidiaries.

EXECUTIVE OFFICERS

For information with respect to executive officers, see “Information about ourthe Company’s Executive Officers” in Part I of the Company’s Annual Report on Form 10-K for the year ended April 30, 2020,2022, filed pursuant to the Securities Exchange Act of 1934, as amended.

COMPENSATION OF EXECUTIVE OFFICERS

The following table contains summary information regarding the compensation of the Company’s executive officers as required by Item 402(n) of Regulation S-K.

Summary Compensation Table

| Name and Principal Position | Year(1) | Salary ($) | Bonus ($) | Stock Awards(2) ($) | All Other Compensation(3) ($) | Total ($) | ||||||||||||||||||

| CHRISTOPHER V. VITALE President and Chief Executive Officer of the Company | 2020 2019 | 325,000 318,269 | 60,000- | 47,588 176,250 | 3,705 322 | 436,293 494,841 | ||||||||||||||||||

| ADRIENNE M. ULEAU(4) Vice President, Finance and Accounting of the Company | 2020 | 112,642 | 11,000 | - | 1,450 | 125,092 | ||||||||||||||||||

| JAMES M. MCMONAGLE(5) Former Vice President and Chief Financial Officer of the Company | 2020 2019 | 185,231 197,308 | 15,000- | 9,518 10,575 | 9,743 409 | 219,492 208,292 | ||||||||||||||||||

| Summary Compensation Table | ||||||||||||||||||||||||||||

| Salary | Bonus | Stock Awards(2) | Option Awards(2) | All Other Compensation(3) | Total | |||||||||||||||||||||||

| Name and Principal Position | Year(1) | ($) | ($) | ($) | ($) | ($) | ($) | |||||||||||||||||||||

| Christopher V. Vitale President and Chief Executive Officer of the Company | 2022 2021 | 332,700 325,000 | 100,000 60,000 | 69,000 27,600 | 252,110 - | 14,020 13,710 | 767,830 426,310 | |||||||||||||||||||||

| Adrienne M. Uleau Vice President, Finance and Accounting of the Company | 2022 2021 | 153,800 150,000 | 41,000 15,000 | 28,800 14,100 | - - | 6,420 4,947 | 230,020 184,047 | |||||||||||||||||||||

| (1) | The year references are to the fiscal years ended April 30. |

| (2) | The amounts indicated represent the grant date fair value related to awards of restricted stock and options granted during fiscal |

- 17 -

| (3) | The amounts reported include payment of life insurance premiums and matching contributions to the Company’s Simple IRA |

Outstanding Equity Awards at April 30, 2020

- 13 -

| Stock Awards | ||||||||

| Name | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that have not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or other Rights that have not Vested ($)(1) | ||||||

| CHRISTOPHER V. VITALE | 32,834 | (2) | $ | 158,917 | ||||

| ADRIENNE M. ULEAU | - | - | ||||||

| JAMES M. MCMONAGLE | - | - | ||||||

| Outstanding Equity Awards at April 30, 2022 | ||||||||||||||||||

| Option Awards | Stock Awards | |||||||||||||||||

| Equity Incentive Plan Awards | ||||||||||||||||||

| Name | Equity incentive plan awards: Number of securities underlying unexercised unearned options | Option exercise price ($) | Option expiration date | Number of Unearned Shares, Units or Other Rights that have not Vested (#) | Market or Payout Value of Unearned Shares, Units or other Rights that have not Vested(1) ($) | |||||||||||||

| Christopher V. Vitale | 50,000 | (2) | 14.24 | 11/1/2031 | 12,500 | (3) | 160,750 | |||||||||||

| Adrienne M. Uleau | - | - | - | 4,500 | (4) | 57,870 | ||||||||||||

| (1) | Value is based on the closing price per share of Common Stock of |

| (2) | In November 2021, the Company granted Mr. Vitale an option to purchase 50,000 shares of Common Stock under the AMREP Corporation 2016 Equity Compensation Plan with an exercise price of $14.24 per share, which was the closing price on the New York Stock Exchange on the date of grant. The option will become exercisable for 100% of the option shares on November 1, 2026 if Mr. Vitale is employed by, or providing service to, the Company on such date. Subject to the definitions in the AMREP Corporation 2016 Equity Compensation Plan, in the event (a) Mr. Vitale has a termination of employment with the Company on account of death or disability, (b) the Company terminates Mr. Vitale’s employment with the Company for any reason other than cause or (c) of a change in control, then the option will become immediately exercisable for 100% of the option shares. The option has a term of ten years from the date of grant and terminates at the expiration of that period. The option automatically terminates upon: (i) the expiration of the three month period after Mr. Vitale ceases to be employed by the Company, if the termination of his employment by Mr. Vitale or the Company is for any reason other than as hereinafter set forth in clauses (ii), (iii) or (iv); (ii) the expiration of the one year period after Mr. Vitale ceases to be employed by the Company on account of Mr. Vitale’s disability; (iii) the expiration of the one year period after Mr. Vitale ceases to be employed by the Company, if Mr. Vitale dies while employed by the Company; or (iv) the date on which Mr. Vitale ceases to be employed by the Company, if the termination is for cause. If Mr. Vitale engages in conduct that constitutes cause after Mr. Vitale’s employment terminates, the option immediately terminates. Notwithstanding the foregoing, in no event may the option be exercised after the date that is immediately before the tenth anniversary of the date of grant. Except as described above, any portion of the option that is not exercisable at the time Mr. Vitale has a termination of employment with the Company immediately terminates. |

| (3) | 2,000 restricted shares of Common Stock that will vest on |

| (4) | 833 restricted shares of Common Stock that will vest on July 7, 2022, 1,000 restricted shares of Common Stock that will vest on July 15, 2022, 833 restricted shares of Common Stock that will vest on July 7, 2023, 1,000 restricted shares of Common Stock that will vest on July 15, 2023 and 834 restricted shares of Common Stock that will vest on July 7, 2024, subject in each case to the continued employment of Ms. Uleau on each vesting date. |

- 14 -

On July 15, 2020,13, 2022, the Company awardedapproved the following compensation for Mr. Vitale and Ms. Uleau a $15,000 cash bonus and 3,000Uleau:

| · | effective as of July 18, 2022, the annual base salary for Mr. Vitale was changed from $335,000 to $350,000 and the annual base salary for Ms. Uleau was changed from $155,000 to $170,000; |

| · | Mr. Vitale was awarded a cash bonus of $150,000 and Ms. Uleau was awarded a cash bonus of $55,000; and |

| · | the Company awarded Mr. Vitale 8,000 restricted shares of Common Stock of the Company under the AMREP Corporation 2016 Equity Compensation Plan that vest as follows: 2,666 shares on July 13, 2023, 2,666 shares on July 13, 2024 and 2,667 shares on July 13, 2025, subject to the continued employment of Mr. Vitale on each vesting date and the Company awarded Ms. Uleau 2,100 restricted shares of Common Stock of the Company under the AMREP Corporation 2016 Equity Compensation Plan that vest as follows: 700 shares on July 13, 2023, 700 shares on July 13, 2024 and 700 shares on July 13, 2025, subject to the continued employment of Ms. Uleau on each vesting date. |

In November 2021, the Company that vests one-third on July 15, 2021, one-third on July 15, 2022 and one-third on July 15, 2023, subjectentered into an employment agreement with Mr. Vitale. Pursuant to the continued employment of Ms. Uleau on each vesting date. On July 17, 2020, the Company awarded Mr. Vitale a $60,000 cash bonus and 6,000 restricted shares of Common Stock of the Company that vests one-third on July 17, 2021, one-third on July 17, 2022 and one-third on July 17, 2023, subject to the continued employment of Mr. Vitale on each vesting date.agreement,

| · | Mr. Vitale will serve as the President and Chief Executive Officer of the Company for a base salary of not less than the rate in effect immediately before the date of such agreement, which resulted in a base salary of $335,000 per year. |

| · | The parties agreed to provisions relating to vacation, paid-time-off, office location, confidentiality, invention assignment, non-competition and non-solicitation. |

| · | Upon any termination of Mr. Vitale’s employment, the Company will pay and issue to Mr. Vitale any earned but unpaid base salary, the dollar value equivalent of the number of days of vacation and paid-time-off earned but not used, unreimbursed business expenses, unpaid bonus previously awarded by the Company and vested benefits, equity awards or payments (excluding any severance benefits or payments) payable or issuable under any policy or plan of the Company or under any equity award agreement or other arrangement between the Company and Mr. Vitale. |

| · | Upon any termination of Mr. Vitale’s employment due to the death of Mr. Vitale, the Company will pay to Mr. Vitale’s executors, administrators or personal representatives, an amount equal to his then-annual base salary which he would otherwise have earned for the month in which he dies and for three months thereafter. |

| · | Upon any termination of Mr. Vitale’s employment by Mr. Vitale for Good Reason or the Company without Cause and delivery by Mr. Vitale of a release of claims to the Company, the Company will pay or provide to Mr. Vitale (a) a lump sum amount equal to 200% of the highest of (i) Mr. Vitale’s annual base salary in effect immediately prior to the termination date, (ii) Mr. Vitale’s annual base salary in effect on the date 210 days prior to the termination date or (iii) in the event the termination of Mr. Vitale’s employment was for Good Reason, Mr. Vitale’s annual base salary in effect prior to the event constituting Good Reason; and (b) all restricted stock, stock options and other outstanding equity grants with respect to the Company that are held by Mr. Vitale immediately prior to the termination date will become fully vested and, as applicable, fully exercisable as of the termination date. |

- 15 -

| · | For purposes of the employment agreement, the term “Good Reason” means any of the following actions taken by the Company without Mr. Vitale’s consent: a diminution in base salary of more than five percent; the removal of Mr. Vitale as the President and Chief Executive Officer of the Company; a material diminution in Mr. Vitale’s authority, duties or responsibilities as the President and Chief Executive Officer of the Company; assigning any material new duties or responsibilities to Mr. Vitale in addition to those normally associated with his role as President and Chief Executive Officer of the Company; the Company ceasing to be a company subject to the periodic and current reporting requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, or ceasing to have its Common Stock traded on an exchange registered as a national securities exchange under Section 6 of the Securities Exchange Act of 1934, as amended; a requirement that Mr. Vitale relocate his office other than as permitted by the employment agreement; or the failure of the Company to observe or perform any of its obligations to Mr. Vitale under the employment agreement. |

| · | For purposes of the employment agreement, the term “Cause” means the failure of Mr. Vitale to observe or perform (other than by reason of illness, injury, disability or incapacity) any of the material terms or provisions of the employment agreement, conviction of a felony or other crime involving moral turpitude, misappropriation of funds of the Company, the commission of an act of dishonesty by Mr. Vitale resulting in or intended to result in wrongful personal gain or enrichment at the expense of the Company or a material breach (other than by reason of illness, injury, disability or incapacity) of any written employment or other policy of the Company. |

| · | Upon any termination of Mr. Vitale’s employment in connection with a long-term disability, by Mr. Vitale for Good Reason or by the Company without Cause, the Company will pay to Mr. Vitale a lump sum cash payment equal to 200% of the annual cost of medical and other health care benefits for Mr. Vitale, his spouse and his other dependents and an amount equal to the estimated federal, state and local income and FICA taxes related thereto. |

| · | Payments under the employment agreement may be adjusted as a result of section 409A and section 280G of the Internal Revenue Code of 1986, as amended. |

| · | In the event Mr. Vitale is made, or threatened to be made, a party to any legal action or proceeding, whether civil or criminal, including any governmental or regulatory proceeding or investigation, by reason of the fact that Mr. Vitale is or was a director or senior officer of the Company, the Company will defend, indemnify and hold harmless Mr. Vitale, and the Company will promptly pay or reimburse Mr. Vitale’s related expenses to the fullest extent contemplated or permitted from time to time by applicable law and required by the Company’s Certificate of Incorporation. During Mr. Vitale’s employment with the Company and after termination of any such employment for any reason, the Company will cover Mr. Vitale under the Company’s directors’ and officers’ insurance policy applicable to other officers and directors according to the terms of such policy, but in no event for a period of time to exceed six years after the termination date. |

Other than as described below,above, the Company’s executive officers are not subject to agreements or other arrangements that provide for payments upon a change in control of the Company and the Company’s policies for severance payments upon termination of employment apply to the executive officers on the same basis as the Company’s other salaried employees. The Compensation and Human Resources Committee retains the discretion to enter into severance agreements with individual executive officers on terms satisfactory to it. Under the terms of the AMREP Corporation 2006 Equity Compensation Plan, its administrator has the discretion to accelerate the vesting of, or otherwise remove restrictions on, awards under the AMREP Corporation 2006 Equity Compensation Plan upon a change in control of the Company. The AMREP Corporation 2006 Equity Compensation Plan expired by its terms on September 19, 2016. Under the terms of the AMREP Corporation 2016 Equity Compensation Plan and subject to the provisions of the applicable award agreement, restrictions on certain awards under the AMREP Corporation 2016 Equity Compensation Plan shall automatically lapse upon a change in control of the Company.

- 1816 -

COMPENSATION OF DIRECTORS

Compensation for the non-employee members of the Board is approved by the Board, which considers recommendations for director compensation from the Company’s Compensation and Human Resources Committee.

For the period ending June 30, 2019, compensation provided to the non-employee members of the Board was as follows:

Effective July 1, 2019, compensation provided to the non-employee members of the Board is as follows:

| · | Each non-employee member of the Board is paid an annual cash fee of $30,000 in equal quarterly installments. |

| · | On the last trading day of |

- 19 -

| · | The Chairman of the Audit Committee is paid an annual fee of $7,500 in equal quarterly installments. The Chairman of the Compensation and Human Resources Committee is paid an annual fee of $3,750 in equal quarterly installments. Other members of the Audit Committee and the Compensation and Human Resources Committee are not paid any fee with respect to service on such committees. The members of the Nominating and Corporate Governance Committee, including its Chairman, serve without additional compensation. |

| · | In addition to the fees described above, Edward B. Cloues, II is paid an annual fee of $95,000 for his services as Chairman of the Board in equal monthly installments. |

| · | All amounts are pro-rated to reflect any director’s removal or retirement from the Board, any decision that a director not stand for reelection to the Board or any new director being appointed or elected to the Board; provided that, any deferred common share units of the Company that would have been issued on the last trading day of a calendar year to a director who ceased to be a director prior to such issuance date shall be paid in cash rather than as deferred common share units of the Company, where the cash payment will equal the number of shares underlying the pro rata number of deferred common share units that would have been issued to the director multiplied by the closing price per share of Common Stock reported on the New York Stock Exchange on the last trading day of the calendar year. |

| · | There are no separate meetings fees for the Board or any committee thereof. |

The Board believes that significant stock ownership by Board members further aligns their interests with the interests of the Company’s shareholders. Accordingly, each current non-employee director is expected to ownmaintain ownership of at least 30,000 shares of Common Stock of the Company by July 1, 2022 and to maintain such ownership thereafter.Company. Newly elected non-employee directors would be expected to meet this level of ownership within five years of their election to the Board and to maintain such ownership thereafter. Non-employee members of the Board may satisfy the ownership guidelines with Common Stock in these categories: shares owned directly or indirectly and time-vested restricted stock, deferred stock units or restricted stock units. The Board may modify this policy in its discretion.

- 17 -

The following table summarizes the compensation earned by the Company’s directors for fiscal 2020:2022:

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1)(2) | Total ($) | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1)(2) | Total ($) | ||||||||||||||||||

| Edward B. Cloues, II | $ | 144,170 | 25,000 | 169,170 | 132,504 | 30,000 | 162,504 | |||||||||||||||||

| Theodore J. Gaasche | 35,000 | 25,000 | 60,000 | |||||||||||||||||||||

| Robert E. Robotti | 39,375 | 25,000 | 64,375 | 33,750 | 30,000 | 63,750 | ||||||||||||||||||

| Albert V. Russo | 35,000 | 25,000 | 60,000 | 30,000 | 30,000 | 60,000 | ||||||||||||||||||

| (1) | The amounts indicated represent the grant date fair value related to awards of deferred common share units during fiscal |

- 20 -

| (2) | The following table sets forth the number of deferred common share units issued to each non-employee director on the last trading day of calendar year |

| Name | Deferred Common Share Units Issued on the Last Trading Day of Calendar Year 2019 | Total Outstanding Deferred Common Share Units | Deferred Common Share Units Issued on the Last Trading Day of Calendar Year 2021 | Total Outstanding Deferred Common Share Units | ||||||||

| Edward B. Cloues, II | 4,180 | 12,411 | 1,973 | 17,896 | ||||||||

| Theodore J. Gaasche | 4,180 | 12,411 | ||||||||||

| Robert E. Robotti | 4,180 | 11,198 | 1,973 | 16,683 | ||||||||

| Albert V. Russo | 4,180 | 12,411 | 1,973 | 17,896 | ||||||||

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information as of April 30, 20202022 concerning Common Stock of the Company that is issuable under its compensation plans.

| Plan Category | (A) Number of securities to be issued upon exercise of outstanding options, warrants and rights | (B) Weighted average exercise price of outstanding options, warrants and rights | (C) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (A)) | (A) Number of securities to be issued upon exercise of outstanding options, warrants and rights | (B) Weighted average exercise price of outstanding options, warrants and rights | (C) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (A)) | ||||||||||||||||||

| Equity compensation plans approved by shareholders | 48,431(1) | - | 440,050(2) | 102,475 | (1) | - | 405,639 | (2) | ||||||||||||||||

| Equity compensation plans not approved by shareholders | - | - | - | - | - | - | ||||||||||||||||||

| Total | 48,431 | - | 440,050 | 102,475 | - | 405,639 | ||||||||||||||||||

| (1) | Represents |

| (2) | Represents shares of Common Stock available for grant under the AMREP Corporation 2016 Equity Compensation Plan less outstanding grants previously made under the plan and the number of shares of Common Stock issued to former directors based on an equal number of outstanding deferred common share units previously issued, but does not |

- 2118 -

CERTAIN TRANSACTIONS WITH RELATED PERSONS

Prior to the sale byIn March 2022, the Company on April 26, 2019acquired an aggregate of Palm Coast Data LLC and certain other indirect subsidiaries2,096,061 shares of Common Stock, representing 28.6% of the Company,Company’s then-outstanding shares, from the Company provided subscription fulfillment services for a company owned or controlled byEstate of Nicholas G. Karabots, Glendi Publications, Inc. and Kappa Media Group, Inc. at a significant shareholderprice of $10.45 per share in a privately negotiated transaction. The total purchase price was $21,903,837.45. The closing price per share of Common Stock reported on the New York Stock Exchange was $11.47 on the last trading day prior to the acquisition. As of the Company, pursuantdate of closing of the transaction, the repurchased shares were retired and returned to a contract determined, by a committeethe status of directors foundauthorized but unissued shares of Common Stock. There are no other transactions with related persons that are required to be independentdisclosed under Item 404(a) of Mr. Karabots, to be fair and reasonable and no less favorable to the Company than would be obtained in an arm’s length transaction with a non-affiliate having a volume of business with the Company comparable to that of Mr. Karabots. The Company’s revenue from the subscription fulfillment services it provided to Mr. Karabots’ company was approximately $132,900 for fiscal 2019.Regulation S-K.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During fiscal 2020,2022, there were no interlocking relationships betweeninvolving the Company’s Board of Directors or Compensation and Human Resources Committee, or the board of directors or compensation committee of any other company, that are required to be disclosed under Item 407 of Regulation S-K.

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s directors, officers and holders of more than 10% of its Common Stock to file initial reports of ownership and reports of changes of ownership of the Common Stock with the Securities and Exchange Commission and the New York Stock Exchange. Based solely on a review of the copies of the reports received by the Company and certain written representations from the directors and executive officers, the Company believes that for fiscal 2020,2022 all required Section 16(a) reports were filed on a timely basis, except that Ms. Uleau, who became the Company’s principal financial officer on March 17, 2020, filed a Form 3 on April 17, 2020 reporting that she did not beneficially own any securities of the Company and that Gate City Capital Management, LLC filed a Form 3 on June 15, 2020 reporting that it beneficially owns 1,455,649 shares of Common Stock. With respect to the delinquent filing for Gate City Capital Management, LLC, (1) the Company does not know the total number of late reports or the total number of transactions that were not reported on a timely basis and (2) based on a review of the Schedule 13D filed by Gate City Capital Management, LLC with the Securities and Exchange Commission on June 5, 2020, Gate City Capital Management, LLC had six transactions between April 7, 2020 and May 29, 2020 that were not reported on a timely basis.

AUDIT-RELATED MATTERS

The consolidated financial statements of the Company and its subsidiaries included in the Company’s Annual Report on Form 10-K for the year ended April 30, 20202022 have been audited by Marcum LLP, an independent registered public accounting firm. No representative of Marcum LLP is expected to attend the Annual Meeting. The Audit Committee has not yet approved the retention of an independent registered public accounting firm for the year ending April 30, 2023 as the Company expects to make its selection later in its fiscal year but expects to engage the prior year’s independent registered public accounting firm to perform quarterly reviews pending the current year’s audit engagement.

- 19 -

Audit Committee Report

The Audit Committee has reviewed and discussed the Company’s audited financial statements for fiscal 20202022 with management, which has primary responsibility for the financial statements. Marcum LLP, as the Company’s independent registered public accounting firm for fiscal 2020,2022, is responsible for expressing an opinion on the conformity of the Company’s audited financial statements with U.S. generally accepted accounting principles. The Audit Committee has discussed with Marcum LLP the matters that are required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the Securities and Exchange Commission. Marcum LLP has provided to the Audit Committee the written disclosures and the letter required by the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed with Marcum LLP that firm’s independence. Based on these considerations, the Audit Committee has recommended to the Board that the financial statements audited by Marcum LLP be included in the Company’s Annual Report on Form 10-K for fiscal 20202022 for filing with the Securities and Exchange Commission.

- 22 -

The foregoing report is provided by the following directors who constitute the Audit Committee:

| Edward B. Cloues, II, Chairman | |

| Robert E. Robotti | |

| Albert V. Russo |

Dated: July 15, 202013, 2022

Audit Fees

The following table sets forth certain information concerning the fees of Marcum LLP for fiscal years 2022 and 2021. The Audit Fees are for services for those fiscal years.

| Fiscal Year Ended April 30, | ||||||||

| 2022 | 2021 | |||||||

| Audit Fees(1) | $ | 120,510 | $ | 118,450 | ||||

| Audit-Related Fees | - | - | ||||||

| Tax Fees | - | - | ||||||

| All Other Fees | - | - | ||||||

| Total | $ | 120,510 | $ | 118,450 | ||||

| (1) | Consists of fees for the audit of the annual financial statements included in the Company’s annual report on Form 10-K and reviews of the unaudited financial statements included in the Company’s quarterly reports on Form 10-Q. |

Pre-Approval Policies and Procedures